mobile al sales tax rate 2019

Mobile AL Sales Tax Rate. Northport AL Sales Tax Rate.

States With Highest And Lowest Sales Tax Rates

Hoover AL Sales Tax Rate.

. In 2018 the Alabama State Legislature passed Act 2018-577 giving tax collecting officials an alternative remedy for collecting delinquent property taxes by the sale of a tax lien instead of the sale of property. PLEASE REMEMBER THAT ALL LOCATIONS ARE CLOSED ON WEDNESDAYS. Currently in Alabama the sales tax rate is 4.

This tax is in addition to the 5 general sales tax levy. Tax Collector Near Me Brandon. This list will be updated weekly.

You can print a 10 sales tax table here. The 10 sales tax rate in Mobile consists of 4 Alabama state sales tax 1 Mobile County sales tax and 5 Mobile tax. Best Restaurants In Downtown Mobile Al.

Huntsville AL Sales Tax Rate. 2 of the countys sales tax revenue goes toward public health and safety. Alabama Legislative Act 2010-268 now mandates that customers using a Visa or Mastercard will be charged a 23fee 150 minimum for each registration year renewed as well as 100.

What is the sales tax rate in Mobile Alabama. Monday Tuesday Thursday Friday. Including city and county vehicle sales taxes the total sales tax due will be between 3375 and 4 of the vehicles purchase price.

AVAILABLE TAX LIENS FOR PURCHASE Here is a pdf for easy viewing of our available Tax Liens Highlighted items indicate that all items with the same parcel number must be purchased at the same time. Average Sales Tax With Local. Majestic Life Church Service Times.

The rate type is noted as Restaurant in MAT and as REST in the ADOR local rates. 2022 List of Alabama Local Sales Tax Rates. The County sales tax rate is.

Sin categoría 0 Comentarios 0 Comentarios. Tax rates provided by Avalara are updated monthly. Restaurants In Erie County Lawsuit.

Montgomery AL Sales Tax Rate. The Food Service Establishment Tax is an additional one percent 1 sales tax levied on the gross proceeds of sales at retail of food andor beverages sold for consumption. For example a Montgomery.

Only one city andor county sales use or lease tax may be collected irrespective of rate. Opelika AL Sales Tax Rate. Mobile al sales tax rate 2019.

Simply put wireless infrastructure investment enables an entire entrepreneurial culture to focus on creating applications and devices to make businesses more productive and to improve the lives of consumers. Begränsade öppettider under sommaren samt julhelger. Oxford AL Sales Tax Rate.

Look up 2022 sales tax rates for Mobile County Alabama. The minimum combined 2022 sales tax rate for Mobile Alabama is. Aroma Indian Restaurant West Palm Beach.

24 rows sales tax. The Alabama sales tax rate is currently. Restaurants In Matthews Nc That Deliver.

Mobile Al Sales Tax Rate 2019. Alabama Legislative Act 2010-268. Phenix City AL Sales Tax Rate.

Feeling Lost In Life At 50. Pelham AL Sales Tax Rate. 2 Reciprocity for City and County Taxes Rule 810-6-5-0401.

By Jan 19 2021 G2 OpenBook 0 comments Jan 19 2021 G2 OpenBook 0 comments. Are Dental Implants Tax Deductible In Ireland. Madison AL Sales Tax Rate.

In addition to taxes car purchases in Alabama may be subject to other fees like registration. Beginning with tax year 2019 delinquent properties the Mobile County Revenue Commission decided to migrate to the sale of tax liens. Mobile Al Sales Tax Rate 2019.

Opry Mills Breakfast Restaurants. Cfs Tax Software Order Form. There is no applicable special tax.

For tax rates in other cities see Alabama sales taxes by city and county. Impingement inklämd sena. Alabama collects a 2 state sales tax rate on the purchase of vehicles which includes off-road motorcycles and ATVs.

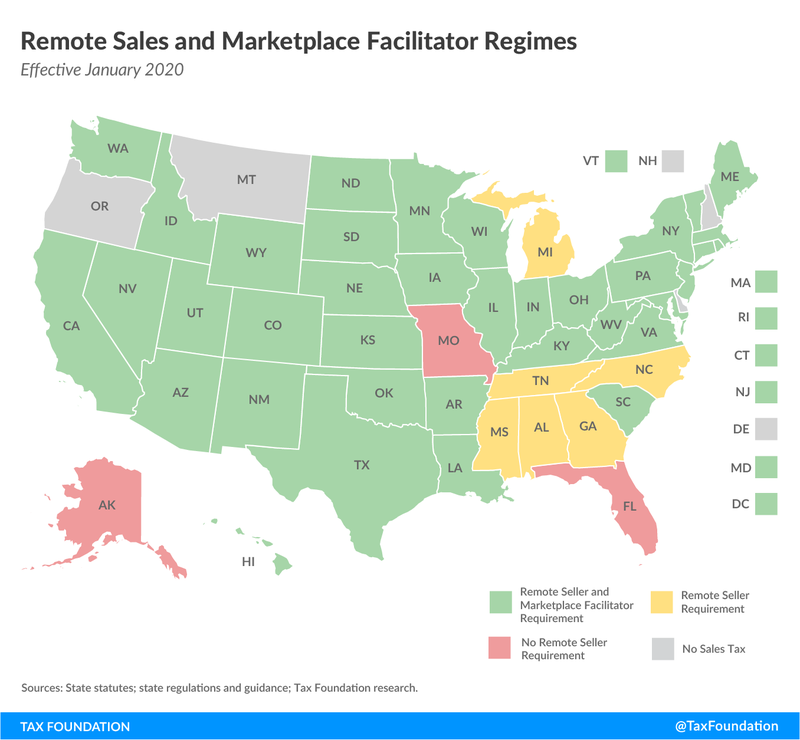

However changes in consumer demand for wireless services pose challenges when measuring the impact of wireless taxes on consumer bills. Alabama has state sales tax of 4 and allows local governments to collect a local option sales tax of up to 7. That ranks behind Tennessee 947 percent Louisiana 945 percent Arkansas 943 percent and Washington 917 percent Retail sales taxes are one of the more transparent ways to collect tax revenue according to.

There is a state sales tax rate an elected county rate and a city sales tax rate listed here. According to Section Alabama a combined minimum sales tax rate of 9 will be required in 2021. Lowest sales tax 5 Highest sales tax 115 Alabama Sales Tax.

The Tax Foundation found that Alabama has the nations fifth highest average combined state and local sales tax rates at 914 percent. Mobile alabama sales tax rate 2019. If you have any questions about purchasing Tax Liens please.

This is the total of state county and city sales tax rates.

How Is Tax Liability Calculated Common Tax Questions Answered

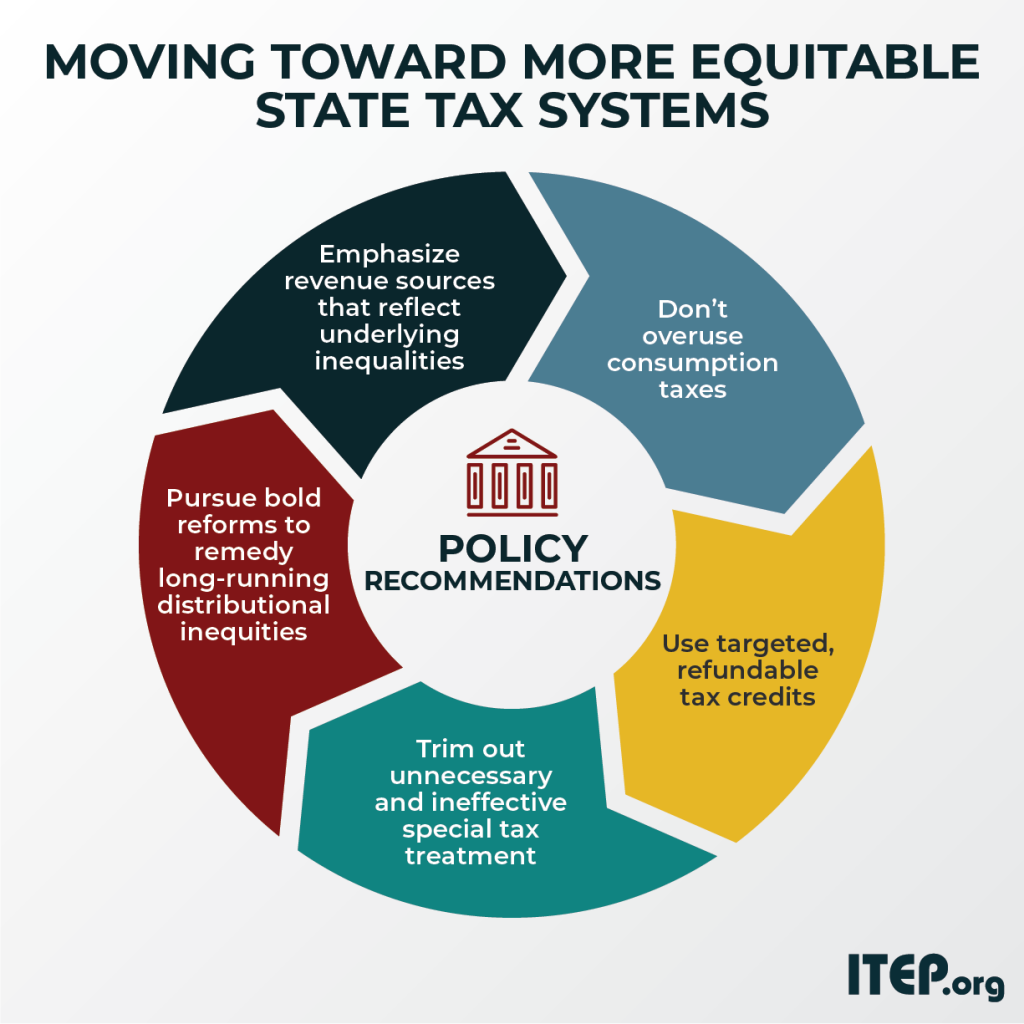

Moving Toward More Equitable State Tax Systems Itep

States Without Sales Tax Article

How Do State And Local Sales Taxes Work Tax Policy Center

States Without Sales Tax Article

Sales Tax By State Is Saas Taxable Taxjar

Sales And Use Tax Rates Houston Org

Alabama Sales Tax Rates By City County 2022

Alabama Sales Use Tax Guide Avalara

States With Highest And Lowest Sales Tax Rates

Michigan Sales Tax Small Business Guide Truic

How Is Tax Liability Calculated Common Tax Questions Answered

How To Calculate Sales Tax For Your Online Store

A Small Business Guide To E Commerce Sales Tax The Blueprint

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)